Global Economic Outlook Post-Pandemic: Navigating Financial Recovery and Growth

The COVID-19 pandemic sent shockwaves through the global economy, disrupting financial markets, businesses, and personal finances. As we move past this tumultuous period, the financial landscape is undergoing significant transformations. Let’s delve into how the global economic outlook post-pandemic affects finance, exploring the opportunities and challenges that lie ahead.

The Financial Impact of the Pandemic

The pandemic’s financial impact was nothing short of seismic. Stock markets experienced unprecedented volatility, with major indices plunging and recovering in record time. Businesses, especially in travel, hospitality, and retail, faced severe financial strain, leading to layoffs and furloughs. Governments worldwide introduced stimulus packages to mitigate the economic fallout, pumping trillions of dollars into economies to support businesses and individuals.

Signs of Financial Recovery: A New Financial Landscape

As we emerge from the pandemic, there are encouraging signs of financial recovery. Financial markets have rebounded, with many indices reaching new highs. Central banks have played a crucial role, maintaining low-interest rates and implementing monetary policies designed to stimulate growth.

Shifts in Investment Strategies

The pandemic has accelerated changes in investment strategies. Investors are increasingly focusing on sectors that have proven resilient or beneficial during the crisis. Technology, healthcare, and green energy have become hot sectors, attracting significant investment. The rise of remote work and digital transformation has led to a surge in technology stocks and a re-evaluation of real estate investments, as more people work from home.

- Technology and Innovation: Technology stocks have soared as companies and consumers embrace digital solutions. Innovations in fintech, telehealth, and e-commerce are driving investment opportunities, offering potential for significant returns.

- Sustainability and Green Investments: There’s a growing emphasis on sustainability, with many investors turning towards green bonds and renewable energy projects. The pandemic has highlighted the need for a sustainable recovery, making eco-friendly investments more attractive.

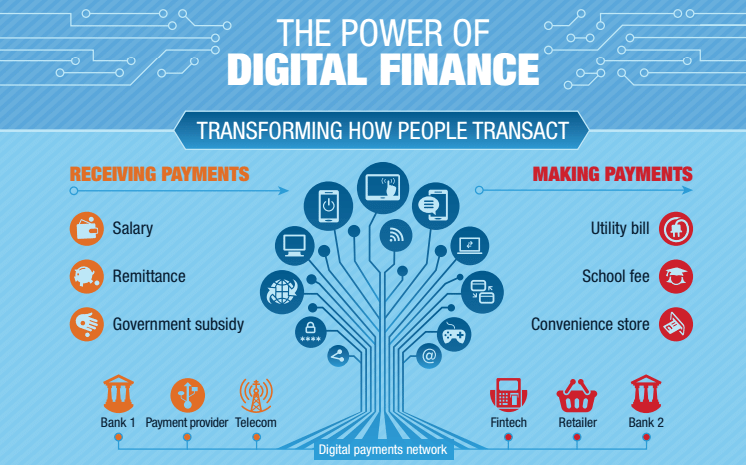

The Rise of Digital Finance

The pandemic has catalyzed a shift towards digital finance. From online banking to cryptocurrency, the financial sector is evolving rapidly. Digital wallets, contactless payments, and blockchain technology are transforming how we manage money and conduct transactions.

- Cryptocurrency: Bitcoin and other digital currencies have gained mainstream acceptance, with institutional investors showing increasing interest. Cryptocurrencies offer an alternative to traditional financial systems and have the potential to reshape global finance.

- Fintech Innovations: Financial technology companies are revolutionizing traditional banking. Innovations like robo-advisors, peer-to-peer lending, and AI-driven financial planning tools are democratizing access to financial services and changing how people manage their money.

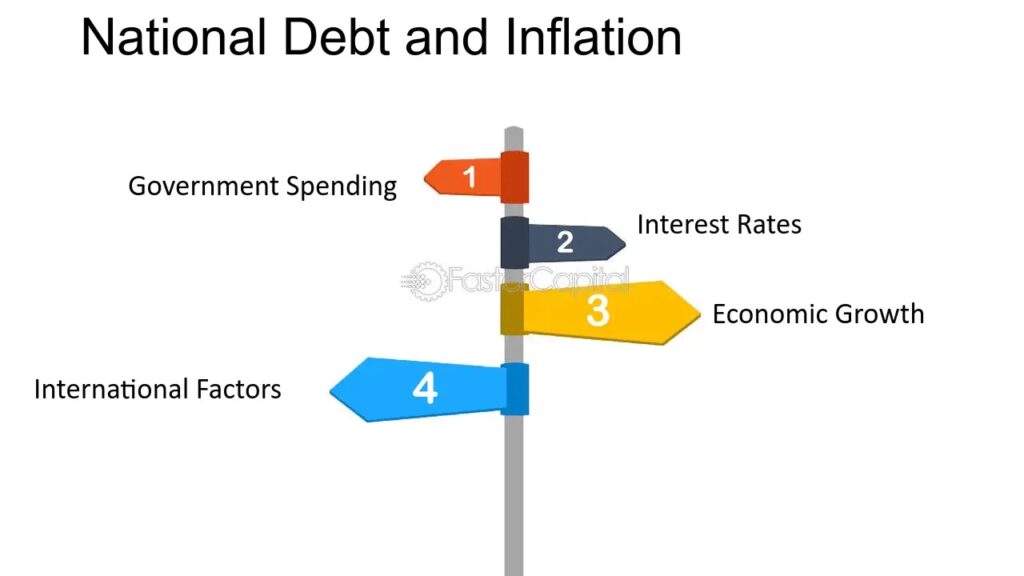

The Challenge of Inflation and Debt

One of the significant challenges in the post-pandemic financial landscape is managing inflation and national debt. As governments have increased spending to counteract the pandemic’s effects, inflation has surged in many regions. This poses a threat to purchasing power and can affect investment returns.

- Inflation: Rising prices for goods and services can erode savings and affect consumer spending. Investors need to be cautious about how inflation impacts their portfolios and consider assets that traditionally perform well during inflationary periods.

- National Debt: The increase in government debt due to stimulus measures is a concern for many economies. High levels of debt could lead to higher taxes or reduced public spending in the future, impacting economic growth and financial stability.

The Importance of Financial Planning

In this evolving financial landscape, robust financial planning is more crucial than ever. Individuals and businesses must navigate the complexities of a post-pandemic world, balancing investment opportunities with risk management.

- Diversification: Diversifying investments across various asset classes can help manage risk and take advantage of different growth areas. A well-balanced portfolio can weather economic uncertainties and capitalize on emerging opportunities.

- Emergency Savings: Building an emergency fund remains a vital aspect of personal finance. The pandemic has underscored the importance of having financial cushion to handle unexpected events and economic fluctuations.

Best Regards

Financial Prosperity معاشی خوشحالی

0 Comments